Bringing financial-plan thinking to giving: Introducing the Philanthropic Planning Report

For Canada Gives’ Foundation families, thoughtful planning is a familiar discipline. Investment strategies are reviewed regularly with their tax and financial advisors. Long-term objectives are modelled and stress tested. Families will regularly work with their trusted advisors to make confident decisions about the future. Until recently, philanthropy has rarely been approached with that same level of structure.

Enter the NEW Canada Gives Philanthropic Planning Report—a tool created to take purposeful charitable giving to the next level. Think of it as a platform that helps our donor clients establish and fulfill a charitable giving strategy that aligns with their personal values, goals and financial resources.

A 360-degree view of a family’s charitable giving

Our Philanthropic Planning Report applies a financial-planning mindset to charitable foundations, offering families and their advisors a clear, consolidated view of how their Donor Advised Fund—or as we call it, a Canada Gives Foundation account—is performing today, how it has evolved over time and what different granting strategies could mean for its longevity and impact.

For donor clients that have been active in the charitable sector for several years, philanthropic activity can become surprisingly complex. Multiple charities. Multi-year pledges. Evolving interests across sectors. Annual disbursement requirements. Investment growth working quietly in the background.

The Philanthropic Planning Report brings all of that information together into a single, coherent snapshot.

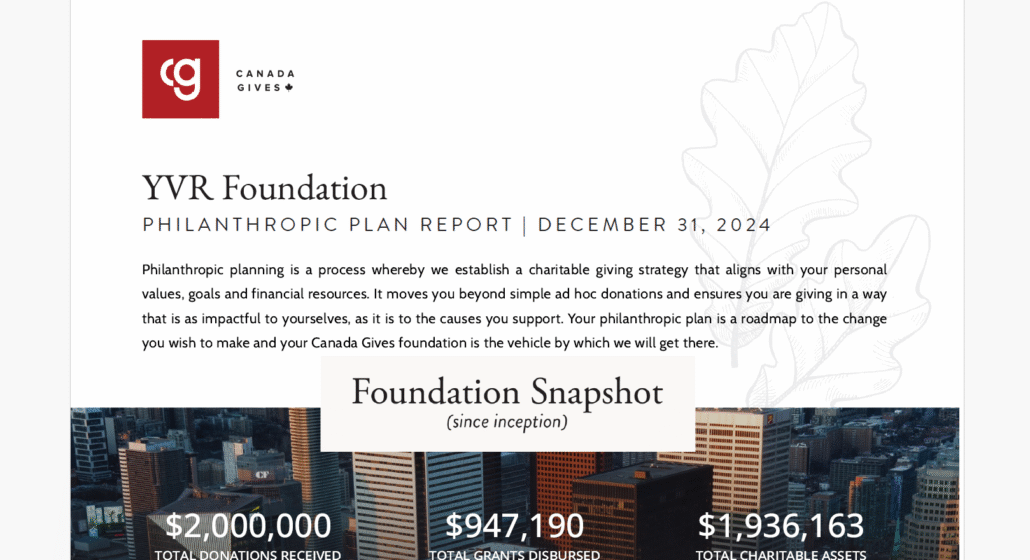

The opening section of the report highlights something many families intuitively understand but rarely see quantified so clearly: the power of tax-free compounded growth inside a Foundation account. By showing total donations received, total grants made since inception and the capital still invested today, the report illustrates how front-loading charitable capital and/or making consistent donations over time—rather than writing one-time cheques—can significantly increase the amount ultimately disbursed to the charitable sector.

For many families, this reframes philanthropy as an ongoing strategy rather than a series of transactions, while underscoring the value of working with an engaged advisory and investment management team.

Aligning values, interests and commitments

The report then moves beyond data to charitable impact.

A sector-level summary shows where a Foundation account’s giving is directed, according to Canada Revenue Agency charitable categories, which aligns closely with Canada Gives’ quarterly reporting. This allows families to see how their philanthropic interests are represented across causes and how those interests have evolved over time.

A detailed summary of gifts and pledges provides a clear record of charitable commitments—helpful not only for reflection, but also for planning future years with confidence. For families who value intentionality in their giving, this overview often becomes a moment of quiet celebration: a chance to step back and appreciate the cumulative impact of their generosity.

Planning for compliance—and beyond

Foundation families must also navigate often complex compliance requirements, including the CRA’s annual minimum disbursement quota. The Philanthropic Planning Report includes a historical record of disbursements alongside required minimums, expressed in clear dollar terms.

Canada Gives’ software tracks both surpluses and deficits, recognizing that surpluses can be carried forward. In practice, Canada Gives Foundation accounts cumulatively grant well in excess of minimum requirements—often in the range of a total of 18 to 25 per cent annually—creating meaningful surpluses. The report can identify these at both the consolidated and individual Foundation account level, providing transparency and peace of mind.

For families and advisors alike, this reinforces that compliance is not simply being achieved but being thoughtfully managed.

How long will my foundation last?

One of the most valued sections of the Philanthropic Planning Report is scenario modelling.

Using historical granting patterns and investment assumptions, our Client Services team can use the report to answer practical questions that naturally arise over time:

- How long will the foundation last if current granting levels continue?

- What happens if annual disbursements increase over the next 10 or 20 years?

- What would it look like to intentionally spend down the Foundation account over a defined period?

If a family decides they want to distribute all remaining capital within 10 years, for example, we can model what that means in terms of annual granting. If preserving the foundation for multiple generations is the goal, we can assess whether current practices align with that intention.

Rather than prescribing answers, the Philanthropic Planning Report provides a framework for informed discussion.

A shared language for families and advisors

While Foundation families consistently value the clarity and reflection the report provides, the response from their trusted advisors has been particularly strong.

Our Philanthropic Planning Report mirrors the structure and discipline of the comprehensive financial plans that advisors already understand. As a result, it elevates philanthropic conversations to the same professional standard as investment and estate planning—a feature that’s not common in the charitable sector.

For advisors working with wealthy families, the Philanthropic Planning Report creates alignment across disciplines and reinforces philanthropy as an integrated part of long-term planning.

Who the report is designed for

While the Philanthropic Planning Report is an indispensable tool, it’s purpose-designed for Foundation families that:

- Have a long-term philanthropic strategy

- Are active grant-makers with sufficient historical data

- Are engaged in structured philanthropy

- Establish a foundation account of $500,000 or more, ensuring investment growth can support ongoing disbursements for many years

As such, the reports offer the greatest benefit when summarizing the activity and impact of the larger, more active Canada Gives Foundation accounts, where these insights will be most useful.

A tool that reflects generosity, not just numbers

Ultimately, the Canada Gives’ Philanthropic Planning Report is not about optimization for its own sake. It’s about honouring the generosity of our Foundation families by giving their philanthropy the same care, clarity and meaning they bring to other areas of their lives.

By combining thoughtful reporting, long-term perspective and advisor-friendly design, this Report helps ensure that charitable capital is not only granted—but stewarded with intention and lasting impact.

The Canada Gives Team

To explore how a DAF might help you build a legacy that reflects your charitable values, consider opening a Foundation account with Canada Gives. Our team is here to help guide your charitable giving with flexibility and foresight. To learn more, contact a member of our team.